Executive Summary

The United States aims to maintain its supremacy in artificial intelligence (AI) as part of its great power competition with China. To this end, the US finds itself pulling the levers of its underlying technical, commercial, defense, political, and geopolitical forms of power. This manifests most prominently in the US’ export control regime on advanced computing technologies, allied cooperation and limitations therein, and China’s response amid its bid to achieve technological self-sufficiency.

However, a suitably comprehensive conception of AI supremacy eludes policymakers. Wranglings over whether AI competition can be usefully conceived as a “race” and what constitutes the endpoint toward which its participants are hurtling causes US AI policymaking vis-à-vis China to adopt a somewhat post-hoc character as innovations in AI proceed.

This report aims to remedy this in two ways. First, it provides a comprehensive account of AI supremacy, which is defined as the greatest relative ability of a state to manage the chain of progressive steps leading from basic AI research and development (R&D) to commercialization of products at scale, and their dual-use defense applications, up to the level of politics and geopolitics in shaping cross-border AI interactions. Second, it offers five recommendations to improve the US strategy toward achieving AI supremacy.

The recommendations cover: (1) targeted federal funding for basic AI research; (2) federal support for STEM education and vocational training; (3) federal support for commercialization; (4) a proactive and multilateral export control regime; and (5) a leadership position for the US in global AI governance.

The Global AI Race

Introduction

Artificial intelligence (AI) is a pivotal catalyst for global innovation, with the United States at the forefront of the development of this transformative technology amid its ongoing great power rivalry with China. However, a notable concern has emerged: the absence of an explicit conception of AI supremacy threatens to undermine the US’ long-term AI strategy. The notion of AI supremacy traditionally has been difficult to define, paralleling disputes about whether competition over AI is a “race.” This report thus aims to accomplish two objectives: first, to define AI supremacy and anchor this concept in the realities of the AI competition thus far; and second, to revise the US’ AI strategy in accordance with a more comprehensive understanding of AI supremacy.

We argue that AI “supremacy” is an indispensable concept. We define it as the greatest relative ability of a state to manage the chain of events leading from basic AI research and development (R&D) to commercialization of products at scale and their dual-use defense applications and up to the level of politics and geopolitics in shaping cross-border AI interactions.

The race for AI supremacy, then, is not just about R&D. It is a complex interplay between groundbreaking innovation and the ability to translate those ideas into real-world applications, both commercially and militarily, and to do so at scale. AI supremacy is therefore undergirded by relevant forms of power, including technical, commercial, defense, political, and geopolitical power to which states have varying degrees of access. The US and China are cases in point. With its vibrant start-up culture and world-renowned research institutions, the US is a force to be reckoned with in the AI space. OpenAI made headlines in 2022 with the release of ChatGPT, a powerful chatbot that sparked the current frenzy surrounding large language models (LLMs). These models, powered by vast amounts of data and advanced computer processing, are at the forefront of generative AI, capable of producing human-quality text, code, and other creative formats. China, in contrast, boasts a staggering volume of AI patent filings. A 2023 report by the World Intellectual Property Organization (WIPO) revealed that Chinese companies and institutions filed over 38,000 generative AI patents between 2014 and 2023, dwarfing the US total of 6,276 during the same period.1 Leading the pack were tech giants like Tencent, Ping An Insurance, Baidu, and the Chinese Academy of Sciences. While sheer patent volume does not guarantee actionable breakthroughs,2 it does indicate China’s distinct focus on commercialization and real-world applications of AI models.

The AI race, however, is global. States with both the intent and the resources to access computing equipment, talent, energy, and data can develop AI within their borders, to some extent. Outside of our US-China benchmark, then, we find this combination of intent and resources emerging in the Middle East, where several states have entered the global AI race. The United Arab Emirates (UAE) and Saudi Arabia, especially, are pursuing the development of indigenous AI ecosystems, each seeking to attain the regional upper hand, throwing their capital behind their stated national AI aims.3

We survey the global race for AI supremacy thus far principally through the story of the US’ export control regime on advanced computing technologies, allied cooperation and limitations therein, and China’s responses amid its effort to achieve technological self-reliance. These dynamics expose the underlying forms of power relevant to states’ pursuit of AI supremacy and how unresolved tensions between them hamper a state’s ability to harness them in tandem. This framing also allows us to explore a case that taps into the technical, commercial, defense, political, and geopolitical dimensions of AI supremacy: the partnership between American tech giant Microsoft and Abu Dhabi-based AI firm G42. This case is instructive for both its initial ambitions and its eventual parebacks, both of which we assess from the perspective of the US’ pursuit of AI supremacy. It reveals a push-and-pull effect between American policymakers’ desire to manage the AI competition across international borders principally through export controls and to draw the UAE away from China’s technological orbit into the US’ by cultivating cross-border commercial relationships — it is a crystallization of an effort to juggle AI supremacy’s underlying forms of power.

This report thus aims to steer the conversation on the global AI race toward a comprehensive conception of AI supremacy that is anchored in the realities of international affairs and US-China great power competition. In this way, we aim to provide strategic clarity for a technological competition that is simultaneously diffuse yet fought on shared terms: as Middle Eastern powers rapidly emerge as formidable contenders in the AI arena, it is imperative to consider their aspirations alongside those of the established great powers. To do this, a conception of AI supremacy that allows analysts and policymakers to switch their frames of reference from discussions of access to AI hardware or talent to the commercial and defense applications of AI models and to the political and geopolitical contours of the AI competition is necessary. A comprehensive notion of AI supremacy will shape the future of the AI competition, alliances, and the global technological order. We ultimately argue that to secure AI supremacy over the long run, the US must expedite the implementation of AI solutions while simultaneously addressing the critical task of defining and assessing AI supremacy — a learning curve that is still being traversed. We provide five recommendations to this end.

What Is AI Supremacy?

According to the previously described definition of AI supremacy, in which we have identified the state as the key actor and the arena as international, this paper’s references to the global AI “race” refer to states’ efforts to become world leaders in their relative abilities to manage the entire spectrum of interactions related to the development and use of AI technology, both domestically and internationally.

We believe that defining AI supremacy this way avoids an over-intellectualizing of AI’s role in world affairs. Such over-intellectualization threatens to both distort the idea of leadership in AI and to reduce a much needed emphasis on a cohesive AI strategy by the US amid its great power competition with China. The key maneuver here is in recognizing that both proponents and opponents of the idea of an AI “race” hit upon vital points regarding states’ pursuits of AI that we adopt here, but tend to fall into two traps: they either abstract too far away from the practical realities of AI’s development and deployment or they attempt to reduce AI to the particularities of a state’s relative economic and political conditions, losing sight of the usefulness of the concepts of an AI race and AI supremacy.

The former position is represented by the Center for a New American Security’s Paul Scharre, who argues in his 2023 book, Four Battlegrounds: Power in the Age of Artificial Intelligence, that there are four key components relevant to AI and relative state power: data, compute (computing power), talent (AI expertise), and institutions (capable of harnessing AI models’ potential).4 Scharre also likens the competition over AI to the US-Soviet space race and its knock-on economic and national security benefits.5 In contrast, then-Center for Security & Emerging Technology analyst Micah Musser, commenting on the relative disparity in 2023 in the pursuit by the US and China of generative AI, represents the latter view: while both states view AI as a strategic technology, different domestic needs and trajectories have led them to place different emphases on generative AI. China, for its part, has historically focused more on computer vision rather than natural language processing (NLP). Moreover, its economic reliance on manufacturing — in contrast to America’s reliance on professional business services — makes chatbots less impressive. Finally, the technology’s propensity to hallucinate interferes with China’s political governance and perceived social stability.6 Musser’s implication is that analysts should “stop calling it a race.”7

Both of these positions, represented at a general level here, offer something valuable. Scharre is correct to point out that data, compute, talent, and institutions are key factors for a state’s relative power in AI, whereas Musser is correct that these factors are leveraged in substantially different ways depending on the domestic conditions of the state in question. The emphasis on AI’s four key components, for their part — while vital — overshadows the need for a sufficiently robust framework through which to assess a state’s share of relative power over AI and allow the analyst to project into the future with confidence.8 In the absence of this framework, the risk of excessive analytic hedging on the future of technology and the utility of the choices states make in reference to it loom large.9 A more comprehensive conception of AI supremacy is needed.

The converse case illustrated by Musser, that there are state-specific conditions attached to the pursuit of AI, does not detract from both a competitive geopolitical landscape vis-à-vis AI (the race) and a meaningful leadership position that one state holds over another (AI supremacy). The proper goal of a geopolitical analyst, we argue, cannot be to dismiss the AI competition as merely the result of misguided threat perceptions of actors on the world stage; rather, their role is to construct a framework flexible enough to accommodate a litany of state-specific peculiarities pertinent to AI but robust enough to assess one state’s relative power over the technology in contrast to another state’s.

As a first stop, we believe exploring China’s ability to quickly deploy AI models commercially allows us to flesh out the value of our definition of AI supremacy.

China’s Quick AI Deployment and the Role of Government

As noted, the ability to commercially deploy AI models at scale matters for AI supremacy as much as the ability to conduct basic AI research. One of China’s core strengths in the quest for AI supremacy is the quick deployment of AI models and the role of government in this endeavor. Indeed, the Chinese State Council’s 2017 “New Generation Artificial Intelligence Development Plan” — a high-level roadmap for the country’s approach to AI through 2030 — explicitly describes its three sets of strategic objectives (marking out objectives in 2020, 2025, and 2030) by linking AI theories and basic research with practical applications in fields like manufacturing, medicine, and defense, among others.10 China is manipulating the commercial dimension of AI supremacy by tapping into the country’s comparatively more nimble handle on the deployment of AI models, giving it an advantage in this link of the chain.

This point about deployment should not be lost amid the recognition that China lags in areas including access to technical resources — such as advanced chips used to train generative AI models — and the agenda-setting ability of American private-sector innovation. We have already noted one such example in the case of ChatGPT and subsequent generative AI enthusiasm.

Another particularly striking example of America’s ability to move up the chain from basic AI R&D to dual-use defense applications is the employment of the machine learning model “Raven Sentry.” American intelligence analysts aiming to predict seemingly abrupt bursts of political violence in Afghanistan in the summer of 2020 contracted Silicon Valley-based experts to train a neural network to this end. The network was trained on historical data on violence with open-source material such as weather data, social media posts, news reports, and commercial satellite images. Within months, the model was capable of correctly judging an attack to be likely with the highest probability (80-90%) 70% of the time, on a par with human analysts, though at much greater speed.11

Because Chinese technological progress is often associated with technology theft from other countries, including the US, its ability to move up this chain — from R&D to execution — is sometimes underestimated. Its ability to similarly tap into a reservoir of private-sector AI talent and extract a mission-applicable AI solution of the kind embodied by Raven Sentry is not typically held in the same esteem by analysts as America’s. There is truth to this. Consider how even China’s “lukewarm” reception of generative AI (putting aside divergent economic reliance on this technology) notably followed America’ stage-setting AI innovation.

Not two years on from ChatGPT’s release, however, the situation has changed. Some Chinese companies have embraced open-source AI — the sharing of in-house technologies or the code governing AI models. This enabled internet company Kuaishou to build “Kling,” a Sora-like text-to-video generator, and release it to users. Shortly after, 01.AI, a startup founded by Kai-Fu Lee, released competitive generative AI chatbot technology. While US-led export controls on advanced computing equipment have a limiting impact, there is some evidence that this kind of research environment has a mutual (though as-yet heavily uneven) influence on Western AI researchers, leading to a partial reversal of the dynamic that typically flows unidirectionally from America to China.12 China’s ability to cultivate an AI research ecosystem that expands this bidirectionality will depend on its grip on lower-level aspects of the AI supremacy chain, namely access to technical resources such as hardware and talent. More than this, Chinese firms are now attempting to construct generative models by writing more efficient underlying code, thereby reducing the need for the most advanced AI chips. The emphasis on the specialized models for tailored purposes, rather than ever-larger models, is illustrated by Baidu Chief Executive Officer (CEO) Robin Li’s remark: “Without applications, having only foundational models, whether open source or closed source, is worthless.”13

In other areas, China’s hold on the commercialization of AI-enabled products is firmer and more assertive. China is leading the charge in smart cars, taking a mere 17 months to produce a batch of 10 million electric vehicles (EVs) after spending 26 years on the first batch of 10 million. EVs made in China are increasingly “AI-on-wheels.”14 As Wendy Chang and Antonia Hmaidi note, the Chinese state’s guiding principle to have AI serve the “real economy” is pronounced in the growth-inducing EV industry, where Chinese-made AI-enabled autonomous driving softwares like XPeng compete with one another.15 (This comes amid new data that half of all vehicles sold in China in July 2024 were either pure electric vehicles or plug-in hybrid vehicles, a jump in sales of new energy vehicles of 37% from July 2023.16) Finally, Baidu’s deployment of 500 autonomous taxis available for consumers to hail in Wuhan made it, as of July 2024, the world’s largest self-driving car network, covering 2,000 square km more than that of US-based Waymo’s largest autonomous vehicle network in Arizona.17

To be sure, the existing dynamism of advanced scientific and technological research in the US coupled with the near-term effects of US-led export controls on Chinese AI research means that China’s ability to build agenda-setting AI models lags. The point of our emphasis here on the fuller conception of AI supremacy, however, is China’s ability to both develop and deploy commercial AI models at scale even in considerably constrained internal conditions (political censorship) and external conditions (export controls). Hong Kong-based investor Jennifer Zhu Scott recently argued in this vein that China’s constraints do force its technology companies to accept limitations on their ability to build models that compare to the size of, say, OpenAI’s GPT-4, but these limitations enable a pragmatic approach to the development of AI models that allows China to “excel in execution: finding product-market fit, scale, and making applications highly affordable.”18 Indeed, a September 2024 Information Technology & Innovation Foundation report surveys the state of Chinese innovation and cautions against underestimating it in key industries, particularly as it catches up in robotics, AI, quantum computing, and the like.19

This is reflected, in part, by Musser’s insight that China’s economic reliance on manufacturing — in contrast to America’s disproportionate reliance on professional business services — leads the former not only to place less emphasis on rolling out generative AI-enabled chatbots, but also less emphasis on replicating the exact trends toward larger models pursued by American companies like OpenAI, Microsoft, and Google. China’s approach to AI deployment is also a manifestation of Scharre’s point that “governments have choices in how they respond to the AI revolution…”20 AI, either in technical form or deployment, is not predetermined, set in stone as it were — a critical point in constructing a strategy for AI supremacy.

So, too, for the US, where the primary tool for managing the AI competition thus far is export controls on enabling hardware for advancing computing technologies, including AI, and an evolving export control regime that appears poised to cover AI models themselves. The US and China are currently locked in a dynamic in which each state leverages the resources and institutions to which each state holds disproportionate access in order to enable movement through the chain.

We turn to this dynamic now and then flesh out how it relates to the quest for AI supremacy.

The AI Race Through Export Controls

The race for AI supremacy has led to the use of export controls and other regulatory measures by the US on an unprecedented scale. This use has unfolded in tandem with broader trade disputes stemming from perceived inequalities in the US-China trade relationship, including (but not limited to) Chinese acquisition of sensitive US technology for military modernization purposes. Indeed, tensions that escalated sharply during President Donald Trump’s first administration in the form of tariffs on the order of hundreds of billions of dollars on imported Chinese goods from 2018 to 2019, triggering a tit-for-tat dispute between the two states, run parallel to this history.21

An early volley came in May 2019, when President Trump signed an executive order banning the installation of foreign-made equipment that poses a national security risk by US telecommunications firms (implicating Huawei, albeit indirectly).22 In January 2020, Reuters reported that the Trump administration pressured the Dutch government to block chip manufacturing tech sales to China, a campaign with apparent success given that the export license for semiconductor equipment maker ASML’s advanced lithography machine was not renewed.23 By May 2020, the Trump administration amended the foreign direct product rule (FDPR) to restrict semiconductor shipments from global chipmakers to Huawei.24

The Biden administration dramatically extended Trump-era export controls. In September 2022, the US told Nvidia and Advanced Micro Devices (AMD) to stop their exports of A100 and H100 chips as well MI250 chips, respectively, to China.25 In October 2022, the Biden administration published sweeping export controls to restrict Chinese companies from obtaining advanced semiconductors and advanced chipmaking equipment. The controls included a ban on the export of some chips to China made anywhere in the world with US equipment.26 The new controls also prohibited “US persons” (US-based companies or affiliated entities, individuals within the US, and citizens) from providing support for Chinese firms’ development or production of advanced node semiconductors or production equipment without a license.27

The Center for Strategic and International Studies’ Gregory Allen characterized the October 2022 controls as the Biden administration’s way of saying “enough is enough.”28 Shortly after the controls were announced, National Security Advisor Jake Sullivan borrowed the term “small yard, high fence”29 to refer to the US’ new approach of building a wall around critical American technologies to block Chinese access to them without severing the broader US-China trade relationship. In October 2023, these sweeping 2022 export controls were updated with the introduction of new rules designed to restrict China’s “ability to both purchase and manufacture certain high-end chips critical for military advantage.”30

There were several intentions behind the October 2022 export controls, yet all of them bear directly on the pursuit of AI supremacy by the US. As Sujai Shivakumar, Charles Wessner, and Thomas Howell detail in their 2024 report, “Balancing the Ledger,” the controls were designed to block China’s ability to obtain high-end semiconductors, technology, manufacturing equipment, and the technical skill necessary to implement and work with them (following, rather than breaking with, the Trump administration’s 2019 restriction of US companies’ export of goods and services to Huawei without licenses).31

To complement the American export control regime,32 President Joe Biden signed an executive order in August 2023 mandating that US companies both notify and be approved by the Department of the Treasury for outbound investment in the sensitive technology sectors of “countries of concern.”33 These technology areas include “semiconductors and microelectronics, quantum information technologies, and artificial intelligence sectors that are crucial for the military, intelligence, surveillance, or cyber-enabled capabilities of a country of concern…”34 Outbound investments in AI specifically require Treasury Department notifications even where the design, fabrication, and packaging of less-advanced circuits are concerned and in those cases where AI-enhanced software has military or intelligence applications.35 This executive order was implemented through the Treasury Department’s publication of its “Final Rule” in October 2024, providing the terminological specifics necessary for implementation.36

Secretary of Commerce Gina Raimondo indicated in July 2024 that the export control regime vis-à-vis China would continuously evolve and that the fence in the titular “small yard, high fence” approach could never get too tall “because China is constantly trying to get around the fence”37 (though the yard, conceivably, could get too large). The US Congress, for its part, is also getting in the game. In May 2024, the House Foreign Affairs Committee passed the Enhancing National Frameworks for Overseas Critical Exports (ENFORCE) Act by a vote of 43-3.38 The ENFORCE Act — while not a done deal — would amend the Export Control Reform Act of 2018 by granting clear authority to the US president to restrict the export of AI systems (as opposed to merely restricting their enabling hardware, like semiconductors) and to restrict Americans from working with foreigners to develop AI systems deemed a risk to national security.39 Its bipartisan passage out of the committee represents an emerging consensus in Washington on the need to comprehensively restrict Chinese and other adversarial access to advanced AI technologies.

US-Allied Cooperation on Export Controls

So dramatic were the US’ Oct. 7, 2022, revisions to its export controls that the role of allies — specifically, ensuring that allies who dominate critical points in the relevant supply chains are in alignment with American restrictions — took on a somewhat post-hoc character. The Biden administration has been and continues to be engaged in extensive efforts to bring aboard allies, including the Netherlands, Japan, and South Korea, but the record is patchy.40

Japan and the Netherlands were the first to reportedly agree to join the US in imposing some restrictions on the export of semiconductor manufacturing equipment to China in January 2023, prominently implicating the sales of Dutch company ASML’s deep ultraviolet lithography (DUV) machines and similar limits on Japanese firms Nikon Corporation and Tokyo Electron.41 Later, in March 2023, Japan announced42 that it would restrict the export of 23 types of semiconductor manufacturing equipment to align with American restrictions, specifying that the controls restrict the export of machines that could be used to manufacture sub-14 nanometer chips.43

More recently, as the Commerce Department weighed export controls on proprietary AI models to complement the current controls on enabling hardware,44 the US was reportedly engaged in an effort to expand its export control agreement with the Netherlands and Japan as of July 2024.45 While there is alignment in the desire to pursue greater supply chain sustainability, Japan is particularly reluctant to embrace the American totality of export controls on China as it develops its own domestic semiconductor industry alongside concern for China’s leverage over critical mineral supply chains.46

Also in July, American officials reportedly considered employing the FDPR to impose controls on foreign-made products with even minimal American technology as a means of cajoling Japan and the Netherlands into restricting the repair and servicing of chipmaking equipment already subject to export controls.47 Illustrating the touch-and-go nature of US-allied negotiations, there was, shortly thereafter, an anticipated exemption of Japan, the Netherlands, and South Korea from a forthcoming US rule change on the export of semiconductor manufacturing equipment from certain foreign countries to Chinese chipmakers.48 The saga culminated with reports in August 2024 that the Dutch government decided in favor of aligning itself with US restrictions to withhold the renewal of ASML’s licenses to service and provide spare parts for the company’s DUV machines in China49 (the 1970i and 1980i DUV immersion lithography tools, specifically50), temporarily capping US-Dutch negotiations over the imposition of restrictions on servicing equipment, to explicit Chinese dissatisfaction.51

Still, alignment over export controls among the US, Japan, and the Netherlands remains a work in progress. Washington is negotiating a deal with Tokyo to curb chipmaking technology exports to China that the former previously sought to establish before the November presidential election, as strains on the trilateral dialogue appear with Japan’s wariness of Chinese blowback.52 US officials remain intent on pressuring Japan to restrict firms like Tokyo Electron from selling advanced chipmaking tools to China, preferring not to invoke the FDPR against Japan and other allies, though not ruling the option out. As talks proceed, Chinese officials have threatened to cut off Japan’s access to critical minerals essential for automotive production, prompting US and Japanese officials to construct a strategy to ensure the latter’s supply.53

Notably, in mid-October 2024, Taiwan Semiconductor Manufacturing Corp. (TSMC), which is subject to US export controls, independently discovered that it had received a request from a customer for chips that ended up in a Huawei product.54 The Huawei product appears to be, according to reports, the Ascend 910B, which contains chips used for training AI models.55 TSMC itself notified both the US and Taiwanese governments,56 with reports indicating that TSMC could trace the sanctioned shipments back to Oct. 11 at the earliest.57 Note, also, that the political link in the chain of American power — Congress — was also activated, with the chairman of the US House of Representatives Committee on China demanding answers from the Commerce Department and TSMC.58 While not a US ally, the case of TSMC’s sanctioned shipment illustrates both the stringency of US export controls on advanced chips and the stakes of preventing their leakage.

To be sure, the story of US-allied cooperation on export controls vis-à-vis China is both mixed and unfinished. As Aaron Mc Nicholas, a staff writer for The Wire, noted in an August 2024 piece for the magazine, while the trend may well be temporary, ASML’s largest customer over four quarters as of the second quarter of 2024 was China, likely due to the as-yet permitted purchasing of legacy chips less advanced than 7 nanometers59 (though, importantly, the aforementioned restriction on servicing and provision of spare parts for DUV machines to China by ASML was not in force as of Mc Nicholas’ writing). This story will continue to be written in a way that intertwines with the US’ pursuit of AI supremacy.60

The Chinese Responses Amid a March to Autarky

In an echo of the Trump-era reciprocal US-China trade disputes, Chinese leaders have responded to the sweeping October 2022 export controls and their subsequent updates — though China’s efforts at technological self-reliance are not, importantly, only in reaction to post-October 2022 American actions. Much to our central thesis here, China, owing to its differential share of relevant AI power, is forced to find creative outlets through which to retaliate.

In May 2023, China barred operators of key domestic infrastructure (including telecommunications, transport, and finance) from purchasing Micron Technology products after faulting the American firm for failing a network security review.61 The move, Shivakumar, Wessner, and Howell note, was intended to cut the market share of US firms in critical technology sectors.62 Shortly thereafter, in July 2023, China imposed licensing requirements on the export of rare-earth metals gallium and germanium (over which China has production dominance, at least for now63) and any compounds resulting from them.64 The cost of gallium rose outside of China in tandem as germanium’s price jumped with Chinese stockpiling.65 This move was followed by yet another regulatory counter-measure: in August 2023, China withheld regulatory approval for a contract between Intel and Israeli chip manufacturer Tower Semiconductor that would have merged the two companies.66

Moreover, China reportedly re-mounted an earlier effort to recruit elite, foreign-trained scientists. The initiative, which is a revival of what was called the “Thousand Talents Plan,” aims to build up Chinese technological self-sufficiency67 by attracting foreign talent in sensitive areas — prominently among them, semiconductor expertise — through incentives like home-purchase subsidies and sign-on bonuses of 3-5 million yuan (or $420,000 to $700,000). Most selected applicants to the new program are reported to have at least one PhD from a top US university.68

These retaliatory measures should not be understood as an indication that China is merely responding to post-October 2022 US actions, however. In September 2022 — when the Biden administration, as noted, began to curb high-performance chip exports to China minus its later full-throated measures — a Chinese government directive was put out by the State-Owned Assets Supervision and Administration Commission to expand the country’s efforts to remove US technology from Chinese computers (including their hardware, operating systems, and other software). “Document 79,” so-named only for the numbering on the directive’s pages, is initially targeting hardware makers such as Dell, IBM, and Cisco with the aim of replacing these American firms’ technology with Chinese competitors’, leveraging China’s annual state-sector spending of 48 trillion yuan in 2022 (or $6.6 trillion).69 Chinese leaders are, and have been, intent on achieving technological autarky for some time.70

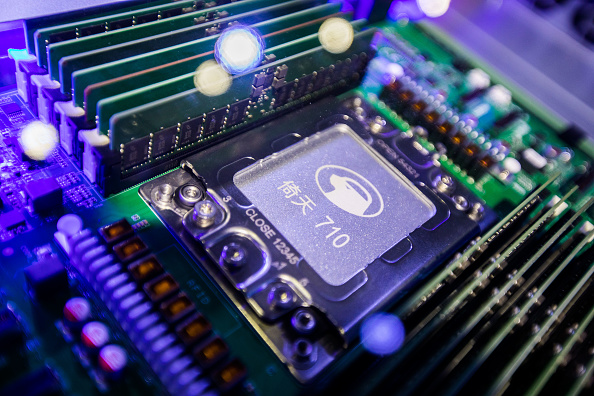

The effort, known informally among some Chinese vendors as “Delete A,” continues apace, with Semiconductor Manufacturing International Corp. (SMIC) on the frontlines.71 Although SMIC’s technology is several generations behind TSMC and Samsung Electronics, it is using “homegrown semiconductor-production equipment”72 in manufacturing. SMIC is capable of producing only 28-nanometer circuits (the kind typically used in household devices and cars) rather than more advanced chips used to train generative AI models. Yet Huawei’s Mate 60 smartphone uses an SMIC-made chip constructed with technology comparable to the 7-nanometer process. Doubts, to be sure, exist about the efficiency of the process used to attain this breakthrough and whether it can be done at scale.73 SMIC appears to have exposed the chip to DUV lithography multiple times — as opposed to the use of extreme ultraviolet (EUV) lithography for 7-nanometer chips — in a process called “multi-patterning.” While this allows the firm to manufacture such chips, the manufacturing yield is lower, the rate of machine usage is higher, and the cost of energy and maintenance requirements increase in tandem.74

As of September 2024, Chinese regulators, most prominently the Ministry of Industry and Information Technology, issued guidance — rather than legally binding instructions — to Chinese firms that encouraged them to reduce purchases of Nvidia chips (such as the H20) in favor of chips produced by domestic Chinese vendors. Huawei and Cambricon Technologies Corp. are the leading vendors in this respect. Importantly, recognizing the limits of domestic chipmaking capacity while encouraging AI innovation, the guidance makes clear that foreign semiconductor purchases are tolerated for the time being, when necessary.75

To clarify the limits on Chinese technological self-sufficiency in the near term, Hanna Dohmen, Jacob Feldgoise, and Charles Kupchan noted in “The Limits of the China Chip Ban,” published by Foreign Affairs in August 2024, that while Chinese firms like Huawei and Biren have been catching up to Nvidia and AMD in the design of advanced chips (in 2019 and 2022, respectively), they generally lag in manufacturing advanced-node semiconductors, estimating that SMIC is five to six years behind the state-of-the-art.76 The 7-nanometer SMIC chip is, then, a loophole in US-led export controls, though one with significant qualifications.

As of August 2024, Huawei — acting in part on the mission to “Delete A” — was reportedly nearing the point of introducing its new AI chip, the Ascend 910C, developed under the conditions imposed by post-October 2022 export controls. Huawei tells its potential clients that the chip is comparable to Nvidia’s H100 (currently restricted on export to China). SemiAnalysis’ Dylan Patel suggested that the 910C may perform better than Nvidia’s B2077 (a chip in the “Blackwell” series designed for compliance with US export controls and set for distribution in China in the second quarter of 202578). To be sure, the 910C must exceed a high bar to be truly competitive. According to a Center for Security & Emerging Technology analysis of the 910B, an earlier chip in the same series, the progress from the first and second-generation chip in the Ascend 910 series is incremental — merely 1.2 times the performance of its predecessor — whereas leading chips in the industry have tripled their performance over a similar period.79

Middle East Entanglement

The US-China AI competition, when this story is told through the lens of America’s export control regime and Chinese efforts at technological self-sufficiency, exposes each of the core forms of power underpinning AI supremacy — technical, commercial, defense, political, and geopolitical. The US leverages its dominant hold over the technical dimension of AI power in areas including basic, agenda-setting research as well as its grip on the geopolitics of AI through both its full-throated export control regime to restrict Chinese access to the technical resources necessary to produce cutting-edge models in areas like NLP and its alliances to ensure the former’s completeness.

But the AI story is being written globally. In the Middle East, the UAE and Saudi Arabia in particular are aiming for regional AI leadership with eventual world-class ambitions. Both states, in addition to the aforementioned willingness to throw their respective capital behind AI-related investments, are moving at full speed on indigenous data center construction. By the end of 2023, the UAE had 235 megawatts (MW) of total data center capacity and Saudi Arabia had 123 MW (still lagging behind Western Europe where, for example, Germany’s capacity totals 1,060 MW). With regional ambitions come regional necessities, including the construction of data centers that can withstand the heat-intensive, desert environments in which they are built.80

Saudi Arabia, in September 2024, additionally partnered with US-based semiconductor startup Groq (an Nvidia competitor) to build the world’s largest data center specialized for AI processing, anticipated to be operational by the end of the year.81 Most strikingly, in October 2024 the Saudi Public Investment Fund (PIF) and Google Cloud announced a strategic partnership to create a new global AI hub in the kingdom.82 Representing the growing significance of the Middle East in the global technology ecosystem, the partnership will see a PIF-funded and Google-operated data center with associated cutting-edge tensor processing units (TPUs) and graphics processing units (GPUs), joint marketing of Google’s AI products to regional and international clients, and a critical local workforce upskilling initiative.83

The disruptions to supply of AI chips caused by the growing deployment of export controls on a global scale, in addition to the hurdles in attracting and retaining limited AI talent and access to computing power, nonetheless make the US-China competition the locus of the AI race in the Middle East.84 We focus on the Middle East’s increasing entanglement in the US-led export control regime vis-à-vis China and weave this into a broader discussion of AI supremacy.

The Middle East in the Post-October 2022 Export Control Regime

Highlighting fears of the loss of advanced American-made semiconductors to third-party countries, the US imposed stricter export licensing requirements on Nvidia’s A100 and H100 chips, as well as AMD’s MI300 chip, to some Middle Eastern states in August 202385 (following earlier reporting that prompted the US to deny it had blocked the sales outright86). In October 2023, the export controls issued on Oct. 7, 2022, were geographically expanded. Using updated criteria to identify what counts as “controlled” chips, the US Bureau of Industry and Security (BIS) required that 44 countries, including Middle Eastern states, be subject to the relevant licensing restrictions.87 These updated controls covered all six member states of the Gulf Cooperation Council (the UAE, Saudi Arabia, Qatar, Bahrain, Kuwait, and Oman).88 In April 2024, the BIS revised and clarified two of the Oct. 17, 2023, rules, principally clarifying the products, parts, and components that require pre-export notification to BIS and a BIS license for initial export.89

It was later reported in May 2024 that, as US officials conducted a national security review of AI development in the Middle East, the issuing of licenses to chipmakers, including Nvidia and AMD, for large-scale AI accelerator shipments to the Middle East (chips that enable data centers to better process information relevant to AI development) was delayed or unresponsive to applications.90 Later, in September 2024, BIS announced that it would expand its Validated End User (VEU) program, which allows US exports to ship advanced semiconductors to pre-approved data centers that meet specified physical and cybersecurity standards without requiring exporters to obtain multiple individual export licenses.91 In October 2024, Biden administration officials relatedly discussed (without commitment) capping advanced AI chip sales from Nvidia and AMD to some countries, focusing specifically on the Persian Gulf, to build on the VEU program.92

All this goes to show that Middle Eastern actors intent on harnessing AI find themselves engaged in a “delicate balancing act”93 amid the dynamics born of the US-China great power competition for much of this period of intensifying commercial and geopolitical enthusiasm for AI.

The tenor of these dynamics as of late-2024, however, represents something of a shift from previous months amid the surge in global capital to fund the buildout of AI infrastructure. The UAE especially is acting to ensure its position at the forefront of these efforts. Recent events do, to be sure, follow an ongoing and intensifying stream of AI-related action.

Abu Dhabi has been engaged with OpenAI CEO Sam Altman’s efforts to establish a new chip-building venture to reduce dependency on Nvidia since at least early 2024.94 The Abu Dhabi-based and state-backed AI investment fund MGX was later reported to be at the center of discussions on funding such a chip venture.95 The UAE continued to engage with Altman as he met with multinational investors and government officials, including in the UAE in April, to discuss private-sector cooperation with governments on the development of large-scale AI infrastructure (this included meeting with US ambassador to the UAE Martina Strong while in the country).96 As of September, Abu Dhabi’s engagement with Altman continued as an anticipated financial backer of the latter’s rallying of global investors to invest hundreds of billions of dollars in AI infrastructure.97 Perhaps most strikingly, MGX reportedly sought to invest in OpenAI during the company’s latest, multibillion-dollar funding round98 (following an earlier and lower-profile purchase of a stake in OpenAI competitor Anthropic by UAE sovereign wealth fund Mubadala in March99).

Outside of its engagement with Altman and OpenAI, MGX is also reportedly partnering with BlackRock and Microsoft on an alternative AI infrastructure fund with the aim of raising $30 billion for data center and related power infrastructure investment. The partnership is doubly significant as it not only positions the UAE as a central player in a major effort to deploy up to $100 billion in total capital for infrastructure investments, but it also would secure the state’s position in a longer-term AI investment scheme where expected returns are modest and comparatively more stable.100 That same week, G42 and Nvidia announced a collaboration on AI solutions to improve global weather forecasting accuracy with the aim of establishing an operational base and climate technology laboratory in Abu Dhabi.101 During his subsequent official visit to the US in September 2024, UAE President Sheikh Mohammed bin Zayed Al Nahyan met with CEOs Satya Nadella, Larry Fink, and Jensen Huang of Microsoft, BlackRock, and Nvidia, respectively, reaffirming the state’s commitment to cross-border AI-related cooperation.102

Finally, chipmakers TSMC and Samsung Electronics have discussed — without commitment — building plant complexes and other major chipmaking operations in the UAE, respectively, with government officials. While the deal remains uncertain, the initial terms outline funding by the UAE for the relevant projects, a primary role for Mubadala, and an objective of reducing chip prices by increasing global chip production without harming chipmakers’ profitability. In a reflection of the continuing reality of the Middle East’s place in the US-China tech competition, the firms have held discussions with US government officials over the production and shipment of chips from UAE-based factories and do not expect to break ground on the projects until a resolution is reached.103

US export controls, then, shape the region’s AI ambitions, though they do not, as we see starkly in the case of the UAE, remove the ambitions. Rather, states like the UAE act within the parameters set by the post-October 2022 export control regime, sometimes leading US officials to react rather than merely anticipate AI-related developments. To focus and sharpen our analysis of the US’ pursuit of AI supremacy and the Middle East’s role in the global AI race, we explore a case study in US-UAE relations: the Microsoft-G42 partnership.

The Microsoft-G42 Deal: A Blueprint for Future Tech Partnerships

In April 2024, US technology giant Microsoft invested $1.5 billion in the UAE-based AI firm G42. The investment gave Microsoft a minority stake in G42 and a board seat held by Microsoft President Brad Smith. The deal notably required negotiations and assurances by both the US and UAE governments regarding the security of advanced technology exchange.104 The need for assurances arose from three key factors. First, the rise of G42 — a reflection of the UAE’s own tech-economic ascent — as a major AI player. This prompted the US to ensure that the UAE and G42 align more closely with the US-led tech-economic coalition and to prevent any spillover of US intellectual property into China. Second, amid the intensifying tech competition with China, US intelligence officials expressed concerns about the potential transfer of advanced American technology to Chinese companies.105 Furthermore, G42 would be granted access to run and sell indigenously produced AI applications and services on Microsoft’s Azure cloud services. Part of the assurances on the UAE’s part involved removing Huawei-made equipment from G42’s systems, following earlier divestment from Chinese companies, including ByteDance.106

The perceived security stakes associated with this deal cannot be underestimated.107 Microsoft indeed touted the partnership as including a “first of its kind Intergovernmental Assurance Agreement” for AI safety and security standards.108 Secretary Raimondo, who played a central role in brokering the agreement, framed it as a zero-sum choice between being in the American or Chinese technological orbit, with the deal drawing the UAE into America’s.109 In contrast, however, US Congressional China hawks became concerned in May 2024 that the deal could backfire by preemptively authorizing the transfer of advanced US-designed semiconductors from Microsoft to G42 (in addition to leaks of advanced American technology).110 That same month, Brad Smith noted in an interview that a potential second phase of the deal could include the transfer of advanced semiconductors, tools, and even model weights from Microsoft to G42 — but noted that no timeline existed for this phase and that it would require Commerce Department approval.111 Reflecting the diversity of interests involved in the partnership and Congressional concerns about the export of advanced chips from the US, in August 2024 Microsoft shared with Congressional aides that the company would lease its AI products to G42, thereby granting it greater oversight over hardware and software transfers to the UAE.112

Evidence of a shift in these dynamics and the resolution of earlier concerns emerged in September. Public reporting indicates that the US authorized the sale of cutting-edge chips to G42, including H100s, after significant efforts were made by the latter to secure sensitive data (such as the physical locking-down of new data centers built exclusively with Western-made hardware).113 That same month, two new joint AI centers were also announced to be established in Abu Dhabi under the auspices of the Microsoft-G42 partnership,114 including a Global Engineering Development Center that Microsoft touts as the first of its kind in the Arab world, devoted to “AI innovations, cloud technologies and advanced cybersecurity solutions globally” while serving the end of “attracting top tech talent from around the world…”115

In this partnership’s evolution, each underlying form of AI power is recruited: the partnership itself is driven by a combination of American technical and commercial dominance and a need to expand its geopolitical reach by engaging states like the UAE that are amenable to outside cooperation. Wary, however, of advanced technology loss to states like China (where the defense implications loom large), US Congressional concern — political power — induces Microsoft to scale back the partnership. Yet the needs of AI supremacy persist. In September, Brad Smith noted that while Microsoft seeks “clarity and consistency” on chip export controls to the Middle East, he also said, “I feel confident that clarity is emerging,” and whereas export applications by Microsoft and other companies are “not 100 per cent complete, they’re getting very close.”116

Thus, while the positioning of the UAE amid the US’ post-October 2022 export control regime is still evolving, America’s pursuit of AI supremacy so deeply intertwines with AI ambitions emanating from the Middle East — principally as a result of Chinese technological influence and ambitions in the region — that push-and-pull effects between the technical, commercial, defense, political, and geopolitical links of the AI supremacy chain are repeatedly exposed and then hammered out as a blueprint for technology partnerships is developed.

The Race for AI Supremacy in the Microsoft-G42 Deal and US-Allied Cooperation

Both the Microsoft-G42 deal and US-allied cooperation over export controls provide valuable case studies in the pursuit by the US of AI supremacy. Developments therein tap into the push and pull between the technical, commercial, defense, political, and geopolitical forms of power underlying AI supremacy.

For its part, the Microsoft-G42 partnership links technical and commercial developments occurring principally within the US and emerging rapidly within the UAE with geopolitical ends — the former seeking to retain and grow its competitive edge in a technology of global importance and the latter seeking to build out its indigenous AI industry on which it has a certain level of external dependency. Moreover, it appears to have been negotiated from the US’ standpoint in part with the expectation that it anticipates a blueprint by which future AI and advanced technology partnerships are constructed.

On a more fine-grained level, the deal represents America’s effort to retain AI supremacy over its chief adversary, China, by drawing in a Gulf state partner whose technological ambitions are both real and amenable to external cooperation — explicitly so, as the UAE ambassador to the US, Yousef al-Otaiba, wrote in April 2024 that the deal represents one way in which “the UAE is working with the US and other partners to write a new playbook for this breakthrough technology.”117 Indeed, the UAE president’s delegation to Washington in September 2024 noted that the US-UAE relationship is in “realignment mode” and explicitly emphasized that the state is “in a less geostrategic and a more geoeconomic phase.”118 Affirming our claim that the US seeks to expand its technological orbit by drawing in the UAE, the two countries, during this presidential visit, signed a “government-to-government memorandum of understanding” on AI which includes a brief set of “Common Principles for Cooperation” for AI and “related” technologies.119

The lesson from the US’ engagement with states like the UAE thus far, and in particular through the Microsoft-G42 deal, is that America cannot escape the competing tensions between AI supremacy’s core dimensions in its pursuit of AI supremacy. The political dimension flared in Congressional concern over advanced technology loss, leading the Microsoft-G42 partnership to experience a pressure-induced scaleback. Yet it is this tension between political power and other links in the AI supremacy chain that makes the case valuable for US AI strategy-formation: It is precisely the US’ perceived technical dominance that triggers tension with the geopolitical link of the AI supremacy chain. The driving motivation to safeguard technology perceived to be significantly more advanced than competitors’ leads to an incomplete strategy for AI supremacy, as the core dimensions of AI supremacy cannot be managed cohesively.

The US does possess a firm lead in the technical dimension of AI power, and US decision-makers do wish to extend the geopolitical umbrella of American technological might — but the dominance in the technical dimension creates a tension with the commercial, political, and geopolitical links in the AI chain that would achieve both ends satisfactorily. Indeed, the paring back of the Microsoft-G42 deal is beneficial for our analysis, as it illustrates the extent to which political power can be misaligned with the US’ cohesive management of the chain from R&D up to geopolitics.

To be sure, as the partnership develops, aforementioned reporting that US officials authorized the sale of H100 chips to G42 (at least for select data centers) indicates an understanding that these tensions must be resolved, to some extent, for the sake of US AI supremacy. The progression of the partnership with the establishment of two AI centers in Abu Dhabi reinforces this point. Even beyond the Microsoft-G42 partnership, that the US is engaging as earnestly as it is with the UAE on funding for large-scale AI infrastructure (along the lines of Altman’s proposal) despite its recent levying of export controls on the region leads Fortune’s Sharon Goldman to suggest the AI-related dependencies between the US and UAE are more mutual than they may appear.120 Against this backdrop, the US’ engagement with Middle Eastern states like the UAE in its pursuit of AI supremacy fundamentally must grapple with the same forms of underlying power, but the tensions that arise between them may shift, sometimes abruptly, as the perceived need of one dimension (e.g., the commercial need for new energy sources and data centers) may supersede another (e.g., the wholesale restriction of advanced AI-related technology to certain states).

US-allied cooperation on post-October 2022 export controls is not, of course, a mirror image of the Microsoft-G42 deal. While highly post-hoc, the US’ efforts to align with allies that occupy critical points in the global semiconductor supply chain continue to find significant success. The Dutch government’s August 2024 decision, following negotiations with the US, to withhold servicing and repair licenses for ASML’s DUV tools is one example of the US successfully leveraging its share of geopolitical power pertinent to AI.

These efforts, however, have planted the seeds from which future tensions in the pursuit of American AI supremacy may grow. The geopolitical leverage that the US holds over its close allies is currently being used as a tool against indigenous Chinese AI development in such a way as to stretch its long-term viability. Relationships with allies cannot be viewed as permanently malleable and infinitely subject to US officials’ efforts to expand export controls, particularly those reacting to unforeseen (and perhaps unpredictable) technical developments inside or outside of China. Successes today do not guarantee successes in the future. The US’ share of geopolitical power relevant to AI can diminish if used inappropriately.

More than this, US allies are doubtless pricing in the practical effects on US trade policy from the incoming second Trump administration. While the new administration is likely to extend an underappreciated continuity in the US’ deployment of export controls vis-à-vis China and advanced technologies,121 the significance of allied cooperation therein is a clear disjuncture. US allies like the Dutch and Japanese, aware of the possibilities, may have cooperated on some export controls in the near term with little expectation of cooperation in the later term where their own interests are felt to be unserved or where they perceive the US’ actions to be too unpredictable.122 This is a prime instance of a tension between the political and geopolitical links of the AI supremacy chain, where the former threatens to disrupt the latter’s continuity.

Taken together, all this holds implications for what an ideal US strategy for AI supremacy looks like, to which we now turn.

Recommendations: Revising the US Strategy for AI Supremacy

The story of US-led export controls on Chinese firms is one in which the US attempts to manage the AI competition principally by tapping into its technical, commercial, and geopolitical power. Chinese efforts at technological self-sufficiency and retaliatory actions in response to US export controls, likewise, tap into its own relevant power. In particular, the “Delete A” directive recruits political power to shape a long-term outcome in the state’s relative AI standing in addition to the country’s ability to quickly deploy commercial AI models.

In the near term, US-led export controls are hindering Chinese progress in basic AI R&D, principally by limiting Chinese researchers’ ability to build models comparable to the sizes and compute requirements of the likes of OpenAI’s GPT-4o and o1 models. It simultaneously hinders Chinese leaders’ broader ambitions to become technologically self-sufficient in the production and acquisition of advanced AI chips — a matter that extends beyond the generative AI race specifically (and more important to Chinese leaders in the long run).

That said, the potentially fatal flaw in the US’ strategy is a lack of cohesiveness across the underlying forms of power relevant to AI supremacy. In concrete terms, this translates into a lack of federal resources devoted to shoring up the ability to deploy AI models within its own borders. Should the US’ export controls prove only temporarily effective in shaping Chinese capabilities, however — and should it adversely affect US chip manufacturers and markets in the meantime — the absence of a broader US AI strategy could condemn its current approach to insufficiency over the long term.

Our foregoing analysis is a direct launchpad for assessing the longer-term prospects for US AI supremacy and the strategy by which it should be pursued. The Microsoft-G42 deal and US-allied cooperation represent case studies that inform our recommendations.

We turn to our recommendations for US AI strategy now:

1a. Expand Targeted US Support for Basic AI Research

The US federal government should expand its support for basic AI research and development. This expansion should be targeted through investments in subfields and approaches in AI that would lay the foundation for breakthroughs that ameliorate the shortcomings of existing state-of-the-art AI models in ways conducive to their commercialization.

This is a familiar recommendation, though one that reveals the push and pull inherent in the pursuit of AI supremacy. Consider, as Amy Zegart argues in Foreign Affairs, how US federal funding for research as a share of GDP declined from 1.9% in 1964 to 0.7% in 2020 (contrasted with China’s 1.3% in 2017). The largesse of basic research funding specifically has diminished by research sponsors like the National Institutes of Health (NIH) and the National Science Foundation (NSF), leaving American researchers with the disproportionately burdensome task of grant-chasing. Paralleling this, the commercial success of AI in the private sector — despite its near-term benefits — is driving talent away from academia into industry, depleting the banks of expertise on which basic research in American institutions depend.123 In the language of our foregoing analysis: the technical and commercial dimensions of American power are at odds with one another in the domain of basic research funding.

In the context of AI supremacy, this should be resolved by using federal funds to develop a fertile basic research ecosystem that complements the thriving private sector focus on forms of AI that appear less risky to investors (e.g., generative LLMs, computer vision-based autonomous vehicles, etc.). The role of the US federal government, in this view, is to secure its prospects for AI supremacy in the long term in part by targeting those approaches and subfields in AI that private-sector investors deem too risky, particularly within the university system.124

The importance of keeping this expansion targeted to approaches in AI that are conducive to real-world application is highlighted in part by defense analytics firm Govini’s 2024 National Security Scorecard, where 9 out of an identified 12 areas of AI spending across the US government have upwards of 65% of their funding stagnating in the R&D phase, “under-investing in the practical, non-R&D AI capabilities that can deliver value today.”125 While we emphasize caution in applying this characterization in a blanket manner across all areas of AI funding (some problems in AI basic research are more difficult and resource intensive than others), we note the importance of identifying those areas where novel techniques are being constructed to solve some of the shortcomings in existing AI models.

This recommendation builds on the major accomplishment already set forth in the 2022 CHIPS and Science Act. Representing an embrace of industrial policy in the domain of advanced technologies, the CHIPS Act directed $280 billion in federal spending over the following 10 years. Of this, $200 billion is reserved for scientific R&D and commercialization, $52.7 billion is authorized for semiconductor manufacturing, R&D, and workforce development, and the remaining $27 billion is allocated for both chip production tax credits ($24 billion) and cutting-edge technology and wireless supply chains programs ($3 billion), respectively. Two years after its passage, 70 semiconductor fabrication plants are being constructed with CHIPS funding (in part) in Arizona126 and Texas, among other states.127 Indeed, as of June 2024, the electronics manufacturing construction sector is receiving $11 billion in realized private investment per month in part due to the CHIPS Act, as Martin Chorzempa notes.128

1b. Recruit Expert Opinion

To appropriately designate federal funds, policymakers should consult with experts from diverse educational, intellectual, and professional backgrounds to ascertain where such funding would be most useful. The diversity herein is not merely surface-level language: given the concentration of AI research into both the private sector and a highly specific field within it (generative AI), now more than ever US policymakers must hear from experts working across approaches in AI — including machine learning, symbolic AI, and hybrid techniques like Neuro-Symbolic AI — as well as those in adjacent fields.

This recommendation finds continuity with the US Senate’s AI Roadmap put out by the bipartisan AI Working Group in May 2024.129 The roadmap builds from forums with experts from academia and civil society, industry, think tanks, and labor unions.130 It recommends funding a “cross-government AI research and development (R&D) effort” that includes research areas such as fundamental and applied science as well as “[f]oundational trustworthy AI topics, such as transparency, explainability, privacy, interoperability, and security.”131 While the Senate’s AI Roadmap remains aspirational, the contents therein indicate a shared willingness to have the US government reprise its role in an era of great power competition as a major player in basic research in a strategic technology, guided by expert opinion.

2a. Expand Support for Science, Technology, Engineering, and Mathematics (STEM) Education and Vocational Training

Expansion of federal funding for STEM education is another familiar recommendation in the context of AI supremacy, though we emphasize that such expansion works hand-in-hand with basic research funding and should, likewise, be targeted. We also wish to emphasize the role of vocational training outside of STEM disciplines.

A joint May 2024 report by the Boston Consulting Group and the Semiconductor Industry Association details how the CHIPS Act is propelling a major uptick in America’s share of semiconductor fabrication capacity, projecting that the US will capture 28% of an estimated $2.3 trillion in private sector investment in wafer fabrication between 2024 and 2032 (up from 9% pre-CHIPS Act).132 That said, the acquisition of talent necessary to maintain the new investments in the US’ semiconductor industry is lacking at both higher and lower echelons. The US semiconductor industry specifically is expected to have a shortfall of 67,000 technicians, computer scientists, and engineers by 2030, whereas shortages currently exist in areas including construction workers, technicians, electricians, master welders, and pipefitters — all of which are necessary for suitable semiconductor manufacturing building and operation.133

We strongly recommend targeted US federal funding that simultaneously expands access to STEM education and vocational training as a direct means of shoring up the US’ share of technical AI power.

2b. Promote Interdisciplinary Education for AI Supremacy

We also recommend a less-emphasized aspect of support for AI-related education: namely, the interdisciplinarity of AI’s development and deployment.

AI is an unusual field whose history is intertwined with a sometimes self-contradictory quest for the creation of a new species of intelligence on the one hand and the development of tools and products for human efficiency on the other. The field has been marked since its inception in the 1950s by over-ambition, unrealistic timelines, and unproductive benchmarks by which models are evaluated, among other notable peculiarities.134 US AI supremacy requires some clarity on what exactly AI is about, as it is possible for even a great power like America to distort and inflate (or deflate, for that matter) the technical dimension of its AI power.

At the same time, according to an August 2024 RAND Corporation report, AI generally (primarily machine learning), is coming under the spotlight for misunderstandings about the problems AI models are designed to solve, the pursuit of cutting-edge models over practical-use cases, and a mismatch between anticipated and actual capabilities, among other deployment-sensitive matters.135

Thus, we also recommend that the NSF support partnerships between academic institutions and industry organizations that focus on bridging disciplines across STEM, social sciences, and the humanities for educational collaboration on how to understand AI’s development, how it should be defined, the human benchmarks by which it is measured, and so forth. Such a venture could be modeled on the NSF’s existing Advanced Technological Education (ATE) program.136

3. Support Commercialization Through Public-Private Funding and Partnerships

We recommend that US federal agencies seek out emerging commercial enterprises engaged in novel, application-oriented AI research through both state funding and public-private partnerships.

First, federal agencies like the Department of Defense, Department of Energy, and the NSF should award industry actors engaging in novel yet promising research with funding conditioned on ameliorating weaknesses in the dominant AI paradigm of machine learning.

Second, federal agencies should seek out partnerships with industry actors working to bridge novel techniques in AI research with practical applications.137

This recommendation comes on the back of recent trends in the American private sector: namely, American firms, including OpenAI, Microsoft, Google, and Meta, appear to be prioritizing revenue-generation through products — applications of techniques in areas like NLP. Moreover, generative AI specifically is experiencing a slow-down in public hype, which may be fruitful for settling on this technology’s most practical applications.138 It also comes just as OpenAI is offering ChatGPT Enterprise services to its first US federal government customer, the US Agency for International Development. All this indicates that, as expectations adjust, practical-use cases are slowly emerging in a domain where security has been a driving concern.139

These convergent events represent an ideal juncture in the cycle of contemporary AI’s commercial deployment for the US federal government to make targeted investments and cultivate partnerships in research areas and companies whose work offers new pathways from technical capabilities to commercialization.

The CHIPS Act was a significant step in the federal government’s role in supporting commercialization. Various components of the law — including regional tech hubs140 and the NSF Directorate for Technology, Innovation, and Partnerships141 — set the tone for the US government’s approach. This recommendation extends such work.

4a. Reduce Technical Inflation in External Risk Assessments

One of the central lessons of the global AI race thus far is that America’s leadership owes principally to its technical prowess in basic AI R&D and to the US’ share of geopolitical power it uses to protect its leadership by restricting the export of advanced chips and chipmaking equipment to China. Indeed, Secretary Raimondo told Foreign Policy in July 2024 that the US AI industry’s models would not be more advanced than Chinese competitors’ were it not for these export controls.142 Raimondo shares this belief in the technical dominance of American AI models with the Congressional China hawks who saw the Microsoft-G42 deal as a flirtation with the loss of sensitive American AI technology. The shared premises among American politicians and policymakers, then, are that (a) America possesses a lead in basic AI research; and (b) should these technical secrets spill beyond US borders to adversarial states, it would supply the US’ rivals with the keys to the future.

The US decidedly leads in basic AI research, and it is consistent with the pursuit of AI supremacy to slow down China’s ability to indigenously produce AI models that set the agenda for future research, as American firms have done. Yet our analysis reveals a push and pull between the technical, commercial, defense, political, and geopolitical dimensions of AI supremacy, as illustrated by the case of the Microsoft-G42 partnership.

This tension is an exemplification of the global AI race’s inherent balancing act. However, the US, to sufficiently revise its AI strategy, will need to find ways to resolve this tension for a simple reason: if the fear of advanced AI technology loss is the driving factor in American-led AI diplomacy, then it will always threaten to hamstring the US’ ability to consistently expand its commercial and geopolitical reach, leading it to merely maintain the lead it currently holds.

Therefore, as a general matter, we recommend that American policymakers avoid inflating the technical dominance of the US AI industry’s models and the trajectory on which private-sector firms have placed them (trajectories that, as noted, are increasingly geared more toward products). The export of state-of-the-art generative AI models, for example, may be considered a matter of national security, though this designation should not hamstring the US’ ability to expand the commercial and geopolitical reach of its AI power.143 AI as a field is subdivided into various approaches and techniques, among which generative AI is only one; generative AI, moreover, does not appear to be the hypothetical end-point of “artificial general intelligence.”144

To expand America’s AI power and achieve long-term AI supremacy is to use the momentum created by the distinctly American successes of generative AI and other private-sector AI accomplishments in the service of furthering AI’s many facets through novel research techniques, hence our recommendations. Technical inflation should be reduced so as to not prevent this movement.

4b. Construct an Aggressively Proactive and Multilateral Export Control Regime

The national security designation of either AI models or their enabling hardware remains a necessity, however, even with a proper calibration in the technical status of a particular technology. Our remarks are therefore linked to a separate recommendation: specifically, US export controls on AI and its enabling hardware should be aggressively proactive and allow for close coordination with partners and allies through a technology dialogue, echoing a recommendation made by Mohammed Soliman to the US-China Economic and Security Review Commission in April 2024.145

An export control regime that continuously evolves in the face of new developments from chief rival China (e.g., Chinese firms’ use of “chiplets”146) risks being overly reactive. We have already seen how this is the case in our review of the export control scene post-October 2022, particularly in the post-hoc effort by the US to align the restrictions of close allies like Japan and the Netherlands with its own. While a reactive posture is understandable given the pace at which the US government is adjusting to the designation of AI as a strategic technology and its role in America’s competition with China — and China’s no-holds-barred bid for autarky — a reactive posture risks relying on an inflation of America’s technical power, sometimes at the expense of its commercial and geopolitical power.

Yet the paring back of the initial arrangement with Abu Dhabi and the recurring need to cajole allies into alignment reveals an overreliance on near-term technical and geopolitical leverage at the expense of a long-term, cohesive strategy for US AI supremacy. We add to this a practical fact: despite the clear near-term limitations US-led export controls are imposing on Chinese firms, some restricted chips from companies like Nvidia are still being smuggled into China through underground networks, including into state-affiliated entities.147 Additionally, as John Villasenor points out, should the US’ export control regime become too expansive — covering too many AI-related technologies — this could have the unintended effect of restricting AI research at American universities that do not want to risk exposure to “controlled” technologies.148

We therefore recommend that the US export control regime place a greater emphasis on being both aggressively proactive in which technologies to designate as matters of national security and to establish a technology dialogue with partners and allies to enable close coordination on compliance and licensing therein.149 We include in this both allies critical to global semiconductor supply chains, especially Japan and the Netherlands, as well as certain Middle Eastern partners whose geopolitical importance is sharpened amid China’s efforts to draw actors in the region into its fold.

A strength of this recommendation is that it echoes the stances taken by others along the spectrum of opinion on US-led export controls. The Center for Strategic and International Studies’ Barah Harithas, for example, puts forward a more pronounced stance on American export control strategy. He nonetheless recommends, similarly, that the US multilateralize export controls with allies and partners to move beyond a dynamic that is “unsustainable” in which the US imposes unilateral controls and expects its allies to follow suit, only to find cautious allies worried about setting undesirable precedents.150 We thus argue that our recommendation for an aggressively proactive export control regime and a technology dialogue with allies and partners sufficiently balances competing perspectives.

5. The US Should Claim a Leadership Role in Global AI Governance

A coalition of US-based companies should be at the forefront of global AI governance. The US should complement the foregoing recommendations at the geopolitical level with a leadership role in governing the development and deployment of AI globally. Washington should take the lead in the construction of a framework for global AI governance — thereby not ceding leadership in this critical area as it did with the European Union on data regulation151 — while remaining engaged with Gulf states like the UAE and Saudi Arabia as they position themselves as leaders in the field in their own right, consistent with our recommendation on export controls above.

In doing so, it would be building upon existing and early successes in this regard. One example is the Political Declaration on Responsible Military Use of Artificial Intelligence and Autonomy,152 a framework for the regulation of the military use of AI throughout the life cycle of a system’s capabilities launched at the Responsible AI in the Military Domain Summit in February 2023. Another is the set of voluntary commitments, secured by the Biden administration, made by major technology firms to build and deploy safe, secure, and trustworthy AI products in July 2023.153

Conclusion